01

Although specialized skilling courses result in stronger sustainable income streams, and significantly higher ROI for the trainee they are currently not funded by government schemes.

02

On account of these courses being longer duration (6 months-2 years) and higher cost (USD 1k-2k) trainees are forced to explore alternative funding streams such as grants and high cost commercial loans to facilitate their participation in these courses.

THE CHALLENGES

Non- Scalable Market

Variable program results in terms of quality, retention and salary make this currently a non-scalable and unattractive market

Limited Donor Funding

There is limited philanthropic funding available, to be constrained further in a post-Covid world which limits the number of students that can be trained

High Credit Rejection Rates

Youth from disadvantaged communities face loan rejection rates of over 80% - due to lack of credit history

Steep Interest Rates

In cases where credit is available, interest rates are very high - over 25% - due to a perception of higher defaults

OUR SOLUTION

FIRST LOSS DEFAULT GUARANTEE (FLDG)

A First Loss Guarantee Structure will enable low income youth to access affordable finance for specialized skilling courses that offer good placement rates, career progression and high return on investment

The FLDG Structure will be a market development partnership between Social Finance and the NSDC to provide affordable skilling loans to tens of thousands of low income youth over a 3-year time horizon

Designing the Solution

Impact investors provide upfront capital to fund student loans for selected credible Training Partners (TPs), creating incentives for programs to be demand-led and focused on outcomes like placements, income levels and continued earning potential. Philanthropic funders guarantee loan repayments in case of a default, thereby allowing expanded reach to ~3-6x beneficiaries (depending on actual loss cover) than in a pure grant model.

The impact investment fund can be evergreened with continuous top up of the loss guarantee pool thus allowing for a multiplier effect across sustained time horizon.

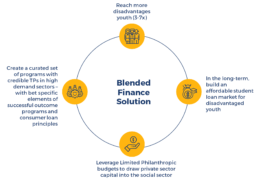

BLENDED FINANCE SOLUTION

Using the grant budgets of philanthropic donors as First Loss Default Guarantee can increase the scale and impact, and build the market for affordable loans in the long-term